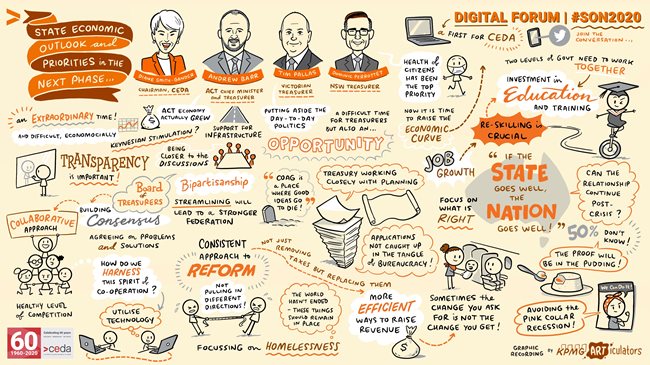

State Treasurer of Victoria, Tim Pallas, told a State of the Nation audience that while COVID-19 has taken a significant toll on the economy, we should see the recovery period as a chance for reform.

“COVID-19 has focused the efforts and activities of every government – we need to maintain these opportunities while building an economic bridge to get to the other side of this crisis,” he said.

“COVID-19 has focused the efforts and activities of every government – we need to maintain these opportunities while building an economic bridge to get to the other side of this crisis,” he said.

Treasurer Pallas was joined by NSW State Treasurer, the Hon. Dominic Perrottet, and ACT Chief Minister, Andrew Barr MLA, to discuss how Australia’s Federation has responded to the health and economic issues brought about by COVID-19.

Mr Pallas spoke further about the way the crisis could drive reform.

“We should not squander opportunities to change behaviours and the opportunity for a national consensus. It is a crisis of course but at the same time it is an opportunity for us to utilise the consensus and the shared concern for economies and the future,” he said.

ACT Chief Minister, Andrew Barr MLA, began his remarks by discussing the relatively strong performance of the ACT economy.

“The March quarter saw our economy grow, which puts us in a very select club around the world at the moment, and that was driven in large part by public expenditure but also by a small positive contribution from private consumption. This goes to highlight the importance of restoring confidence in consumers and the business sector,” he said.

Chief Minister Barr also echoed Mr Pallas’ emphasis on reform.

“We should continue to focus our policy settings on sensible, progressive tax reform and recognising an important role for government over the coming 12 to 36 months not only in supporting infrastructure investment but in stimulating private sector investment,”he said.

Mr Pallas reminded the CEDA audience that despite the scale of the crisis so far, the situation is better than was initially predicted.

“The collective efforts of all Australians have given us more options when it comes to lifting restrictions,” he said.

Treasurer Pallas also said that while the crisis has Treasurers thinking on a different scale of expenditure to what they are used to, it was important that they remember the importance of fiscal discipline.

“We can’t lose sight of the importance of maintaining fiscal rigour outside of the pandemic event,” he said.

Treasurer Perrottet also praised the Australian people’s response to the crisis.

“The sacrifices that people have made have allowed us to ease restrictions and get industries operating at a way that’s close to pre-pandemic but keeping those social distancing measures in place,” he said.

“We have been successful in flattening the health curve we now need to raise the economic curve.”

Speaking on the opportunity for reform, Mr Perrottet said that the cooperation he has seen between governments has been heartening.

“The silver lining of the pandemic has been state and federal interests working across lines to address the national interest. We don’t just have an opportunity to address some of those challenges that have been in the ‘too hard basket’ for decades but an obligation as states and a country to take on those difficult issues to set up our country for future generations to come,” he said.

The panel turned to discuss the recent dissolution of COAG in favour of the National Cabinet and what it means for the Federation.

Treasurer Perrottet said that the new arrangement has made it easier for states to bring ideas to the national level.

“If we are going to be fair about the Federation operating in a strong way it shouldn’t be a top down approach from the Commonwealth,” he said.

“We have an obligation to be promoting ideas and opportunities. What I have seen at the state level is less bureaucracy and more leadership. There is less bureaucracy and less paperwork so we have been able to share ideas and information and at the same time work together on financial agreements and bring forward discussions in a way that has not happened before.

“We have an obligation as leaders in our states and territories to drive ideas so that we can strengthen the Federation not weaken it. On the whole, we have been able to find unity across political lines.”

Mr Pallas agreed calling the National Cabinet a “great and positive step.”

“Having been a participant at ministerial council for many years now these are places where we act decisively and see glaciers whizz past us. We see the same ideas come out time after time and they do not lead to reform,” he said.

“States who are in the business of service delivery to their constituencies need to recognise that we can sit around forever, or we can build a consensus about what needs to be done.

“This is not about ganging up on the Commonwealth it is about creating a position between the states so that they do not have to herd the cats, creating a partner that the Commonwealth can engage with on clear terms.

“We should continue to reform the way the country operates and the way we think about each other.”

Treasurer Pallas elaborated on the opportunity for reform he sees ahead.

“Reform is not a thing that happens in a particular moment and then disappears, we need a long term and committed approach to reforming the way our economy operates. The big test of any government is a consistent approach towards reform,” he said.

Treasurer Perrottet agreed, saying that “we can’t take pre-pandemic thinking into the post-pandemic world.”

Chief Minister Barr highlighted the efforts his government have made to abolish stamp duty and pointed to that as a possible area for reform.

“I pose the question: what if instead of home builder the government had put an equivalent amount of money to remove stamp duty? What if there was a national conversation around tax reform?” he said.

Treasurer Pallas praised the ACT government’s efforts but on the topic of whether his own state was considering similar reforms noted that “tax reform is not just about removing taxes.”

“That means we have to come up with more efficient ways of taxing. Too often we hear some commentators say we should get rid of certain taxes because they are inefficient. If you are getting rid of taxes without replacing them with a more efficient tax then you are making a choice that the state needs to roll back the services it offers,” he said.

Treasurer Perrottet agreed saying the simple removal of taxes was not what he considered reform.

“Tax reform is about getting a system in place that is going to drive jobs, productivity and economic growth,” he said.

The panel concluded by discussing how the crisis has disproportionately affected women and young Australians and how their respective government’s were seeking to address this concern.

Mr Pallas said that “during the course of the pandemic event we relied upon women to be the principal providers of our healthcare services and maintain continuity of support in the household and we know given the areas of employment they are in that they are feeling the brunt of this crisis.”

“To grow any economy you need population growth, participation, or productivity growth. We talk a lot about how we might reform productivity but participation in the labour market will be seriously eroded by the crisis. Principally that will be borne by women, young people and the low-skilled. We need strategies that can reconnect them to the world of work.

“Put simply that will require governments to be focused upon the areas of traditional employment where they might find opportunity, try to move them into areas where they are not traditionally employed such as construction, and reform the skill base to introduce women to areas of work they might previously not have thought of.

“All of these things and so much more will have to be a part of a holistic response that will get those areas of the workforce, particularly women, reconnected back into the economy.”