During February and March 2011 CEDA was pleased to again host events in each State under its headland Economic and Political Overview series. CEDA's EPO 2011 volume provided the catalyst for its contribution to thought-leadership and policy perspectives on the critical economic, political and social issues facing Australia.

An excellent speaker's panel (Appendix 1) treated each audience to expert analysis of the current economic and political issues facing Australia, its neighbours and more broadly. An exceptional group of political and business leaders complemented these presentations:

- Hon Lara Giddings MP, Premier and Treasurer (Tasmania)

- Senator the Hon Penny Wong, Minister for Finance (South Australia)

- Mrs Gail Kelly, CEO, The Westpac Group (New South Wales)

- Hon Andrew Fraser MP, Treasurer (Queensland)

- Hon Troy Buswell MLA, Minister for Transport and Housing (Western Australia)

- Mr Mike Smith, CEO, ANZ Bank (Victoria)

What follows is an overview summary of the contributions made during the EPO series.

Economic overview

- The global financial crisis has accelerated the transition of economic gravity from 'advanced' to 'emerging' economies:

- growth in most 'advanced' economies will be constrained by public and/or household debt burdens

- by contrast most major developing economies have already returned to 'trend' growth, are not troubled by unsustainable public debts, and are instead having to deal with inflationary pressures and potential asset price bubbles.

- Unlike most other 'advanced' economies, Australia stands to benefit significantly from this changing pattern of global economic activity:

- given our resources endowment and existing strong trade links with Asia

- there are some risks around our high levels of household and foreign debt, but Australia doesn't have a public debt problem.

- Australia's economic challenge is to maximize the long-term benefits from the 'resources boom' whilst minimizing inflationary pressures:

- our ability to meet that challenge will be enhanced by disciplined, credible economic policy frameworks that allow market forces to facilitate structural change;

- interest rates and the A$ will remain above historic averages as part of this process.

- The 'resources boom' will result in different parts of the economy growing at different speeds but this is nothing new. Labour shortages critical and solutions needed.

- The 'new frugalism' on the part of Australian households will help to contain upward pressures on interest rates

Several issues dominate the current economic debate in Australia. They are concerned with the international implications of events such as the recovery in the United States, economic uncertainty in Europe, and the continuing significance of Asian economies for Australia, particularly China and India. Domestic economic issues concentrate on the implications of a substantial resources boom, effects of natural catastrophes, the emergence of a multi-speed economy, productivity and resultant effects on consumer behaviour.

International cconomic Issues

- The global financial crisis has accelerated the shift of global economic weight from 'advanced' to 'developing and emerging' economies.

- 'Advanced' economies' debt mountains will curtail their growth prospects whether they deal with them promptly or not.

- Food, energy and metals demand from developing countries plus supply constraints will keep commodity prices high for some time yet.

- US economy is at last showing some signs of self-sustaining improvement, even though the housing sector remains very weak.

- Sovereign debt issue persist in Europe. Whilst Germany remains strong, benefiting from the cheap EURO, other economies such as Greece, Ireland and Spain are under severe pressure, with radical economic reforms overdue. The fundamental problem is that competitiveness has deteriorated relative to Germany. Markets remain sceptical about the efficacy of EURO bailouts, but it is likely to survive although politics could scuttle it.

- Developing and Emerging Economies are being driven by urbanisation:

- Rising Urban Middle Classes and Growing Populations:

- Demand for physical and social infrastructure, better food, brands etc;

- Since 2007, annual $US incremental household consumption growth in Emerging Markets has exceeded best growth years of the USA;

- Emerging Markets share of global consumption estimated at around 35% compared with US 28%;

- Shift activity to Domestic Consumption from exports to the Advanced Economies.

- Trading amongst themselves:

- China exports more to Emerging markets than to G7 countries;

- Brazil exports more to China that to the USA.

- Financially more conservative:

- Low household and Government debt;

- High savings means banks well funded from domestic deposits.

- Asia, particularly China and India are the drivers of economic growth in Asia. Japan is still struggling, and the effects of the current crisis are yet to be appreciated.

- Although Asia is tightening fiscal controls, inflation risks are rising, with a new focus especially on food. This could see interest rates rise. However there is no evidence that China's economic measures to rein in inflation are excessive in the circumstances.

- China matters to the world because it is the swing player in commodity markets. Already China accounts for 50% of global steel.

- Australia's economy is now more closely correlated with China's than with the United States', and is better-placed to benefit from China's rapid growth and industrialization than almost any other Western country

Australian aconomy

- Australia's economy has continued to perform more strongly than those of other industrialized nations.

- Despite politically-inspired claims to the contrary, Australia does not have a public debt problem.

- The resources boom is back, generating rapid growth in incomes (which are not fully captured by movements in real GDP).

- Australia's 'terms of trade' are at their highest sustained level in at least 140 years and mining investment is now larger, as a proportion of GDP, than at any time in the last 150 years.

- The 'mining boom' is getting under way again at a time when there's only a small amount of 'spare capacity' in the Australian economy (Full employment) and evidence is clear that already industrial capacity and labour market are stretched. Short term and longer term solutions are needed- immigration and skills training. Productivity!

- Australian economy on the cusp of a resources investment boom not just limited to WA and Queensland with mining project pipeline now exceeding all other engineering and almost 2½ years mining construction in prospect at current rates.

- The appreciation of the A$ is also playing a crucial role in facilitating the expansion of the resources sector in a non-inflationary way.

- The Reserve Bank's forecasts envisage above-trend growth from this year through 2013, and inflation heading towards the top of the target range.

- Floods impact in Q4 2010 & Q1 2011 severe although reconstruction will boost GDP later in 2011, although they are a 'pot-hole' along the road to a strong economy.

- 'Multi-speed' pattern of economic growth across Australia - by geography and by industry - will persist - but it's hardly anything new. Some areas of the 'multi-speed' economy are soft, with evidence of slowdown in retail sales (clothing, footwear and household goods very poor), housing activity (following the unwinding of boosts to first-home buyer grants and increases in interest rates and being reflected in lower prices) and manufacturing.

- The non-mining sectors of the Australian economy are likely to be 'squeezed' by higher interest rates.

- 'Newly frugal' Australian households are saving more assiduously than their American counterparts - despite much better 'fundamentals' (Savings now 10% of annual household disposable income). Consumer behaviour- paying off credit card, ahead of schedule on mortgage repayments. Even though consumers think it's a good time to be buying major household items, they aren't doing it - they're saving instead.

- Australia an important player in supplying emerging economies:

- Fuel: Coal, Uranium and Gas;

- Food: Cereals, Meat and Fish;

- Fibre: Cotton, Wool, Wood pulp and rayon;

- Mineral Resources;

- Services:

- Education

- Finance

- Tourism (China National Tourism Authority expects Chinese outbound tourism market will reach 52 million in 2010).

- Monetary Policy is comfortably on hold. Having raised the cash rate 25bps on 2 November to 4.75% RBA left rates on hold in December 2010 and February 2011. Whilst the International backdrop has been upgraded the underlying inflation outlook is more benign, although small rate increases are anticipated in 2011. The A$ is likely to stay historically high for some time yet.

- Consideration of the need for some form of Sovereign Wealth Fund is inevitable. If the resources boom lasts 15 years, running a budget surplus of 1% of GDP (as the Government proposes after 2016-17) won't be good enough:

"Another approach would be to reflect the higher income variability in our saving ... behaviour rather than our spending behaviour. We could seek to smooth our consumption [by] allowing the effects to be reflected in fluctuations in saving ... we could seek to hold those savings in assets that provided some sort of natural hedge against the variability of trading partners, or whose returns were at least were uncorrelated with them.... It is possible that this behaviour might be managed through the decisions of private savers. There might also be a case for some of it occurring through the public finances. That would mean accepting considerably larger cyclical variation in the budget position, and especially considerably larger surpluses in the upswings of future cycles, than those to which we have been accustomed in the past."

- Glenn Stevens, November 2010 (CEDA Annual Dinner, Melbourne)

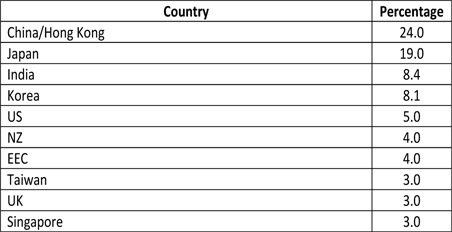

Table 1: Australia's Top 10 Export Markets

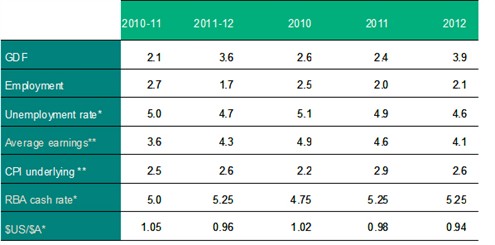

Table 2: Australian Forecasts (NAB)

Political overview

At a National level, the continuing uncertainties in the minds of all participants centred on the longevity of the Gillard Government, its stated political agenda, but its seeming closeness to the Greens. Presenters and participants raised issues such as:

- Election result of November 2010.

- Kevin Rudd's political assassination.

- Labor Government, Labor/Greens or Greens/Labor Government? Can it go the distance? Independents' role.

- Greens and Labor poles apart on many issues such as climate change, taxation policy, desire to close the coal industry, but public seems disinterested in their extreme positions.

- Political agenda that includes implementing the Henry Tax Review, climate change and the carbon tax, illegal immigration, skills shortages, managing the boom, flood levy, industry policy, infrastructure needs.

- Political and governance approaches to skill shortages to develop innovative training schemes. By 2020, skill shortages will be 200,000, putting pressure on wage rates. What is the Government policy to deal with this?

- Changes to State political makeup, and implications for reform and COAG and Commonwealth/State relations.

- Willingness to tackle the productivity needs of Australia, and reflections on the enormous economic changes instituted in the 1980's and 1990's.

- Negativity of the Opposition and unwillingness to engage in national economic debate, although politics well understood.

- Global political uncertainties, particularly in the Middle East with pro-democracy movements. Effect on oil supplies and prices.

- Political will to maximise the benefits for Australia into the future of the current resources boom and adopt a whole of economy theme.

- A population policy for Australia.

- Governments' ability to pay for services. With sectors of the economy shrinking, GST revenues to State Governments are down. Is there a better way that combines public and private partnerships, use of NBN technology or other ways to deliver services more efficiently and effectively?

- Media and how they 'report' the news.

Selected state comments

New South Wales

- Policies for the regeneration of the State economy in the light of likely change in Government.

- New South Wales' economy already showing positive signs in terms of major investment.

- Major challenges for Government continue to be:

- Providing new and upgrading current infrastructure;

- Engagement with the Federal Government through the COAG process;

- Funding Government services due to falling GST revenues because of flatness in sectors of the economy such as retailing.

Victoria

- The recent change of State Government has created some uncertainty in terms of future directions and priorities.

- Concern also regarding commitment to major infrastructure projects - looking for signals.

- Business sentiment is for strong national leadership to address the declining productivity in Australia.

- Also setting of a reform agenda - targeting all governments to be more accountable for efficiencies and outcome focused delivery of services.

Tasmania

- Strengthening world economy.

- National recovery contrasts with Tasmanian anaemia. Tasmania is a regional economy.

- Impact of the GFC in Tasmania - retail and property but the major impact was business investment. Key challenge is boosting investment.

- An economy shifting to services and away from primary, secondary and government.

- Need to boost private sector workforce and skills. Education retention a major issue.

- Population growth helps expand local markets but dependence on exports too.

- Export markets are shifting and presenting new opportunities.

- Key challenge facing SMEs:

- High Australian dollar;

- Electricity costs + carbon tax;

- Water and sewerage costs;

- Wages;

- Accessing and cost of finance.

- Infrastructure needs, local government amalgamations, improved planning processes, need for a regional economic development strategy

Queensland

Mining Largesse

- Capital intensive - income from boom largely produced returns to shareholders.

- Labour benefits are regionalised.

- Returns to labour tend to be regionalised and concentrated (1.2% workers for >4% wage bill).

- Limited leakage throughout State economies - FIFO.

- Benefits dispersed throughout the economy (and to foreign equity owners):

- Commonwealth taxes (captured 1/3 additional national income);

- Capital returns - shareholding and superannuation;

- Greater purchasing power of A$ (as well as having greater negative effect on trade exposed sectors like tourism ).

South Australia

Assuming commodity prices stay high

- Continued development in mining and energy sectors:

- Increased physical investment;

- Stronger Wages growth, Skill shortages, Regional population growth;

- Transport and Energy Infrastructure, Water, Construction Costs;

- Education.

- A$ staying over $US0.90, Oil prices over $US100 per barrel.

- More Foreign investment:

- Lack of Domestic Capital;

- Asian buyers likely to want certainty of supply.

- Impacts on other industries and sectors:

- More opportunities but increased international competition particularly in Tourism and Education;

- Wages and other costs and staff availability.

Long Term Outlook

- Many positive factors are aligning:

-Domestic and International;

-Some negative factors for example industry restructuring, will be of less impact.

- Biggest risk is we will miss the opportunities:

- Skill shortages again;

- Less educated, sicker and less skilled workforce than nationally;

- Over governed and overregulated;

- SA chattering classes' attitudes;

- Changes to defence procurement policies;

- Willingness and Ability to keep changing;

- Mandarin and Hindi language skills.

- Collins Class Submarine support;

- Project Sentinel Australian Customs surveillance;

- Techport;

-7th Royal Australian Regiment Battle Group: 1200 people in 2011;

- RAAF AP-3C Orion capability upgrade and maintenance project;

- Air Warfare Destroyers project;

- New generation submarine project;

- Software: DSTO, BAE, Saab Systems etc;

- Cyber warfare: Virus attack on Iranian nuclear centrifuges;

- Reportedly over 24,000 employed in "Defence" in SA ;

- Should continue to be a growth area for SA;

- Defence Procurement policies: new Committee.

- Likely to need more young adults to support increasing older populations:

- Also in demand for mining and defence;

- Already skill shortages and low unemployment;

- Young are globally needed and mobile: Fleeing HECS .

-Keep over 55s at work longer:

- Issues of Training, Housing, Transport, Insurance, Superannuation.

- Increasing number of single adult and single person households:

- Particularly for elderly;

- 27% single person households in Victor Harbor in 2006;

- Dwelling Demand to grow faster as average no. of people per household falls;

- Changing mix of dwelling needs;

- Age, employment, income, industry mix of new suburbs.

Summary

- Australian economy to grow around 3.75% to 4% real in 2011/12:

- Business Investment, Exports, Rebound in Private Consumption;

- Inflation 2 - 3%, Wages growth lifting 5 to 6%;

- South Australia probably slower:

- Demographics;

- Impact of higher $A and Interest rates;

- Mining benefits coming later;

- Other States will receive more benefit of disaster rebuilding spend:

- Federal Government spending and taxing priorities.

- Forecast 3.25% real growth overall, Employment +2.5%:

- Drivers: Private Consumption, Exports, Private Housing, Business Investment.

- Moderate population growth.

- Exports to lift

- China and South East Asia growing strongly;

- Mining Commodity prices probably close to peaking:

- Withdrawal of US monetary stimulus;

- New supply.

- Good rural seasons.

- Mining Development restarting:

- Mining Resources Tax by whatever name;

- Waiting for Olympic Dam and Others.

- Manufacturing very mixed:

- Offshore competition, high $A;

- Increases for Housing, Defence, Mining investment, Infrastructure and Utilities.

- Public works spending to taper off as Stimulus packages pass through

- Housing Demand to increase:

- Current Shortages, Rising employment, Population growth.

Western Australia

Economic Issues

- Infrastructure projects continue to grow to meet the demands for export due to the increasing demand of China and India. In particular a complete new port, rail and mining project at Geraldton will cost over $4billion. While business and government continue to invest in the economic growth of the State, it must consider the cost of doing business in Western Australia and Productivity vs Gross National Income.

- Reference was made to the COAG reforms to shaping better policy in this area.

Social implications of the multi-speed economy

- Average level of debt increased from 3 times annual income to between 5-7 times income.

- Access to Finance increasingly difficult.

- Median House price more than $450,000.

- Median rental price $380/week.

- Utilities increased significantly in last 2 years.

- Rising social housing waiting lists.

- High rate of homelessness

Six Priorities for Social Investment:

- Investment in Housing - Affordable Housing Report.

- Immediate Investment in Community Service providers to ensure current workforce and capacity for additional load.

- Reform of Concessions and other support mechanisms to ensure that they meet their objectives in the current and future economic circumstances.

- Medium Term:

- Creative and Innovative solutions to working with people in areas of multiple;

- Improving outcomes for people living with disability or mental illness and their carers.

- Consider the establishment of a Sovereign Fund or similar strategy to ensure that social investment is planned not opportunistic.

Complied by

Professor the Hon Stephen Martin | Chief Executive

CEDA

21 March 2011